Section 179

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year.

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year.

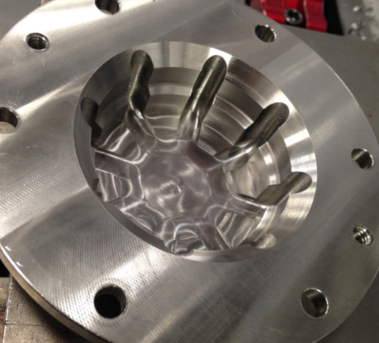

Around 95 per cent of the parts are programmed through Edgecam, and almost all are complex, with tight tolerances of between five and ten microns.

Based in Swansea, South Carolina, ATD operates from a 70,000 square- foot facility in which it produces aerospace and automotive parts; onstruction, HVAC, railroad, and outdoor power-equipment; linear motion components, and parts for various other sectors.

Railroads are operating in a very competitive and regulated marketplace that requires the industry to be constantly maintaining and upgrading its equipment to be more efficient and safe.

Case Study Summary Company name: RTD Manufacturing, Inc. Business: Job shop with a wide array of capabilities Website: www.rtdtool.com Benefits achieved: Machining templates help apply best practices and cut programming time Ability to machine complex surfaces with the software’s 3-axis roughing and finishing cycles RTD Manufacturing Inc.

Case Study Summary Company name: Automation & Control Services, Inc. Business: Coining equipment specialist Website: www.plcexperts.com Benefits achieved: Ability to quickly perform standard, canned functions Increased ability to perform highly-specialized jobs Greater machining efficiency Extended tool life Automation & Control Services Inc, uses SURFCAM Traditional to produce a wide variety of custom solutions for the manufacturing and service industries “We’re training the machinists and designers of tomorrow with tools that will help them, and us, to be as successful as possible.